Phantom Asset Valuation

Phantom Asset Valuation is a specialized brand focused on the appraisal of tangible fixed assets and machinery. We address the practical valuation needs that arise in M&A, financial audits, insurance, and asset management, delivering highly reliable reports that meet the standards of corporate practice.

Depending on the type of asset, the purpose of valuation, and the client’s industry, we select the most appropriate approach. By providing outputs that are credible from financial, accounting, and tax perspectives, we support sound corporate decision-making.

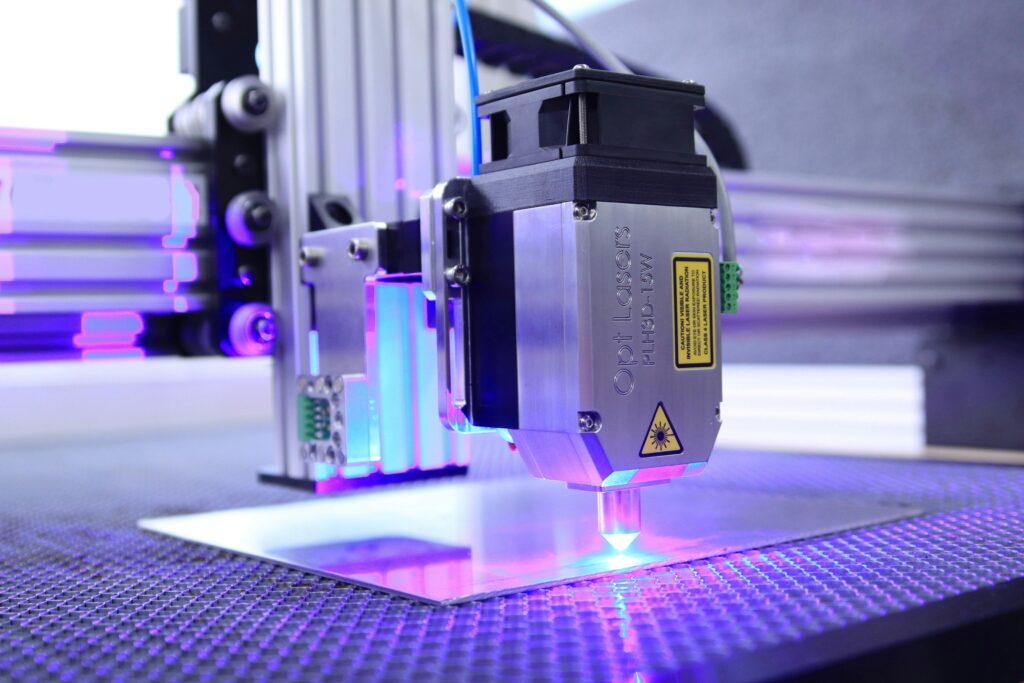

Valuation of Machinery, Plants, and Equipment

We conduct fair value and market-based valuations covering assets such as production facilities, utilities, specialized machinery, and transport equipment. Our services flexibly accommodate everything from individual assets to complex, large-scale plants.

By considering key practical factors—including replacement cost, remaining economic life, and operational status—we apply the most suitable valuation methodology for each asset type, delivering rational, transparent, and practice-oriented results.

Valuation Reports in Compliance with JGAAP, IFRS, and US GAAP

We deliver valuation reports prepared in accordance with major financial reporting frameworks—covering impairment testing, purchase price allocation (PPA), and lease asset valuation. Our reports are structured to align with audit processes, ensuring clarity, consistency, and defensibility.

In addition to JGAAP, we provide full support for IFRS and US GAAP requirements, producing transparent, well-substantiated reports that withstand auditor scrutiny and facilitate smooth financial reporting.

Valuation Network Across Japan and Worldwide

Our capabilities extend from consolidated multi-site and multi-asset appraisals within Japan to cross-border valuation projects covering international subsidiaries. We provide one-stop project support—including site inspections, translation, and coordination with local counterparts—ensuring accuracy, transparency, and smooth execution.

We also design processes that minimize the workload for clients by managing interdepartmental coordination and valuation schedules, enabling efficient, audit-ready deliverables.

Equipment Due Diligence (Equipment DD)

In addition to valuation services, we provide Equipment Due Diligence (Equipment DD) for M&A transactions.

We perform detailed assessments of a target company’s machinery and equipment—reviewing equipment condition, operational performance, maintenance history, required replacement and capital expenditures, and remaining economic useful life. These findings are compiled into decision-relevant qualitative and quantitative insights for the acquirer.

We also perform on-site inspections at manufacturing facilities in Japan and abroad and provide support for pre-acquisition equipment due diligence and pre-PPA valuation procedures. Our service helps identify issues such as equipment aging risk, future capital expenditure needs, production capacity constraints, and operational bottlenecks—factors that are often difficult to capture through financial statements alone. Through these analyses, we provide comprehensive support for acquirers’ decision-making processes, particularly in cross-border transactions.

Comprehensive PPA Engagements Covering Intangible Assets and Real Estate

Beyond machinery and equipment valuation, our firm undertakes comprehensive purchase price allocation (PPA) engagements encompassing intangible assets—including technology, brands, and contractual rights—as well as real estate. For intangible and real estate components, we collaborate with established and reputable external valuation firms, while retaining overall responsibility for project scope, methodology alignment, and schedule management. This structure enables us to provide clients with an integrated, efficient, and audit-ready solution.

Through this coordinated approach, we deliver valuation reports that are consistent, transparent, and defensible—covering machinery, intangible assets, and real estate alike. Our outputs are designed to meet the stringent requirements of PPA and impairment testing under JGAAP, IFRS, and US GAAP, supporting both management decision-making and audit review.